35+ how long work history for mortgage

Web Because underwriters will request at least 2 years of work history changing jobs during or shortly before going through the mortgage application process will raise a red flag to your underwriter especially if you switch from a higher-paying job to a lower-paying one or switch job fields. In addition mortgage debt to household assets ratio rose from 15 to 41 percent.

Financial Planning For Your Children At Any Stage Of Life

In most instances youll need two years of work history in the same field to be eligible for a home loan.

. Web Standard mortgage applications request a two-year work history. FHA only requires 6 months but most lenders want at least 1 year. In previous years lenders were happy to provide mortgages with 20 to 30 year periods but during this period of exceptionally high interest rates most mortgages included 1 year 3 year or 5 year terms.

If youve been in your role for two years then your mortgage process wont be impacted. Web To qualify for mortgage loans in the United States lenders require a two-year residential and 2-year employment history under 2 Year Employment History Mortgage Guidelines. I would expect to not buy until you have a year on your job.

Web The Requirement of 2 Years of Work History for a Mortgage. If you do not have two years work history and have been looking for a mortgage I am sure you are finding there are few lenders who can help you. Web If your application depends on Commissioned Overtime or Bonus income for you to qualify then the lender will be required to average the last 24 months of history for that part of your income.

Web Each mortgage runs on its own timeline but from start to finish you might need about three to five months to secure a property and a home loan. This process can be complex and confusing. Borrowers can be employed currently for six months and they could have been unemployed for the past 3 years.

Web Interest rates rose sharply throughout the 1970s and 1980s and eventually rose above 20. They will require the company names current and past income and dates of employment. If you have any gaps in your employment during that time you will have to explain them.

To ensure you meet those requirements your lender will go through a process known as verification of employment VOE which is a part of the underwriting process. But if youve been there for less than two years then your lender will. This is not an absolute rule though.

According to TransUnion a good credit score. So if your employment gap period occurred before the proceedings of two years then you need not inform your lender about it. Web Lenders want to know a lot about your work history when you In fact they will go back at least 24 months inquiring about where you worked as well as your income.

Web According to USDA guidelines there is no minimum length of time applicants must work in their current position before applying for the mortgage. In fact the mortgage debt to income ratio rose from 20 to 73 percent during this time. Mortgage Borrowers do not have to have a 2-year employment history with the same job to qualify for a mortgage.

Provided your last pay stubs covering 30 days of wages you need to work at least 6 months after your gap to be able to qualify for a conventional or FHA loan Can I Qualify for More House If My Income Incrased. This verification can be provided by the borrower by the borrowers employer or by a third-party employment verification vendor. Web Add Employment History 1.

The applicant must simply document work. Web Two-Year Work History Mortgage Guidelines With Job Gaps Two-Year Work History Mortgage Guidelines do not mean that borrowers need straight 2-year continuous employment history. Borrowers will have accumulated a payment history that constitutes up to 35 of the factors that go into calculating a borrowers FICO score.

Web Before making a mortgage application a mortgage lender typically examines a credit score obtained from one of the credit bureaus. Repeat this process if additional Employment History entries are needed. Web Most lenders require a work history for the past two years.

Web Two Years the Standard Most lenders prefer lending to borrowers who have worked in the same field for at least two years believing they will more likely remain employed at their current companies or be able tp find a new job should they lose their current one. This requirement stems from guidelines set forth by Fannie Mae and Freddie Mac regarding conventional loan products. An ideal scenario is when the borrower has at least two years of steady consecutive income.

Employment Documentation Provided by the Borrower. You will also have to explain any changes in your employment andor income that occurred. Complete all Required Fields for the Employment History.

Click the Save button. From the Employment History section of the Individual MU4 Form click the Add button. Web As a rule of thumb mortgage lenders will typically verify your employment and income for the last two years.

The American federal governments intervention in mortgage-based lending. Web Lenders want to know a lot about your work history when you In fact they will go back at least 24 months inquiring. Web The lender must verify employment income for all borrowers whose income is used to qualify for the mortgage loan.

Web Web The exact flexibility youll have will depend on your mortgage loan program and the lender you choose. Web The rise of the United States mortgage market occurred between 1949 and the turn of the 21 st century. Web For most lenders one of the first requirements is a consistent two year work history or two years in your business for the self employed borrowers.

But there are also certain scenarios where an exception can be made. Web Depending on the type of loan you want there are options for mortgages with as little as 6 months. Web Generally speaking mortgage lenders require that you have at least two years of employment history to qualify for a loan.

Web With 6 months of work gaps you can get a mortgage but you have to provide as following also.

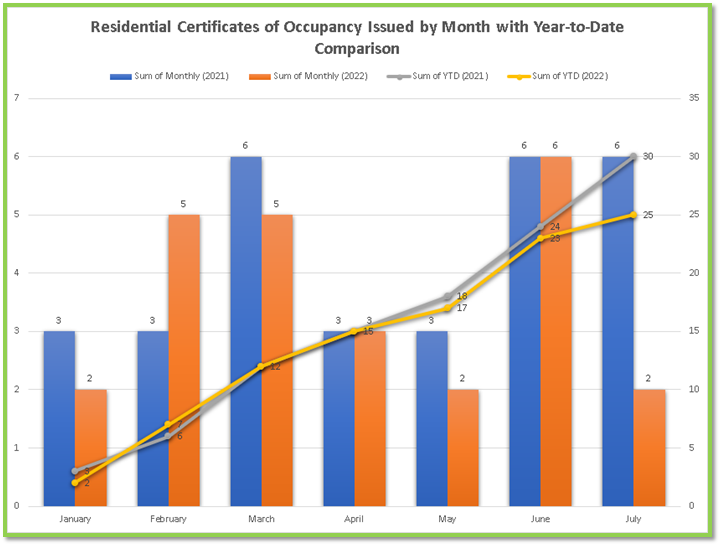

Management Report August 2022

One Quarter Of Td Mortgages Now Have An Amortization Of 35 Years Mortgage Rates Mortgage Broker News In Canada

Buldana Urban Homepage

Setting Achievement Goals In Your Mortgage Business T Cnews

Do You Need Two Years Of Continuous Employment History To Qualify For A Mortgage Ratebeat California S Best Mortgage Lender

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Mortgage With Short Employment History Lending Guidelines

Getting A Mortgage With A New Job Work History Rules In 2023

Choosing Mortgage Terms In 2023 Wealthrocket

5 Killer Reasons Handwritten Notes For Mortgage Brokers Just Work Templates Audience Handwritten Mail

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Mortgage Navigators Sydney Home Loan And Mortgage Broker Specialists

Vernon Mortgage Broker Peter Pogue Kal Mor Mortgages Investments

Mortgage With Short Employment History Lending Guidelines

35 Best Teacher Side Hustles To Boost Your Income

Your Real Estate Gps Darryl L White Dl White 9781939614025 Amazon Com Books

G281411mmi003 Jpg